One of the basic problems of managing finance of resource-supplying company is provision of financial stability that basically depends on volume of funds, drawn into debit liability [1]. Resource-supplying companies usually have organization-administrative documents (standards, regulations, states) that define work with debit liabilities [2] that include:

– Objectives and principles of managing liabilities, methods of accounting and reporting work with debtors;

– Organizing work of commission that manages a company’s liabilities, organizing centers of financial responsibility;

– Classification and analysis of debts according to their liquidity;

– Basic rules, order of measures on prevention of debt growth;

– Business-process of working with actual and outdated debts, analytic account of debtors;

– Approaches towards organizing work on collecting debts in pre-court and court order, realization of control methods, etc.

The most numerous group of energy consumers and, therefore, problematic for collecting debit liabilities is population (private persons), that holds a significant part in total sum of debit liabilities and volume of outdated debts.

Analysis of the existing practice of developing and realizing methods of work with debit liabilities of resource-supplying organizations shows us an insufficient efficiency of this work that is proved by the structure and degree of liquidity of debit liabilities that are shown by companies in their accounting, managing, and corporative report.

For resource-supplying companies that operate with many various contractors, it is critical to define perspectives of working with certain consumers and select optimal financial conditions of work from the point of relation between volume, liquidity of debts, and resourced, drawn to their collection correctly and opportunely.

As analysis shows, basic defect of the existing system of managing debit liabilities of population in resource-supplying companies is lack of clear criterions of classifying debtors according to their significance, as a result, it forms surplus labour resource costs, leads to duplication of measures, implemented to the same debtors in different time periods with decrease of their efficiency.

The most wide-spread parameters of classifying groups of debtors according to significance are: 1) debt sum, 2) period of outdated payment.

In order to solve the problem we suggest implementation of ABC-analysis method that is referred to rationalization tools, as a method of classifying debtors. Facilitation of this method allows one to classify resources of a company according to their significance.

The essence of using ABC-analysis method by a resource-supplying company is in outlining groups of debtors according to statistic data. Groups are defined by their significance and each of them requires a certain approach towards it during further interaction. Algorithm of the suggested approach:

1. Characterize types of debit liabilities, ranged according to decrease in debt sum.

Category A – the largest debtors that require constant and detailed accounting and control.

Category B – less important debtors that are estimated and checked regularly, but not too often.

Category C – the widest nomenclature of debtors with small sums of debts.

2. Types of debit liabilities are defined and ranged according to decrease in period of payment delay.

Category A – debtors with long periods of liabilities, treated with reinforced measures of collection.

Category B – debtors with insignificant periods of payment delay, debts of which are usually collected via pre-court measures.

Category C – reliable debtors who follow payment schedule

Approbation of this method has been carried at processing database of accounting customers of resource-supplying company on a separate marketing department. Statistical processing of data included data on 54 thousand customers with a total sum of debit liabilities equal to 108 million rubles.

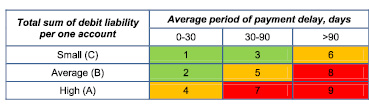

3. In case of combining gradation of debtors according to sums and periods, matrix of managing debit liabilities is formed (fig. 1).

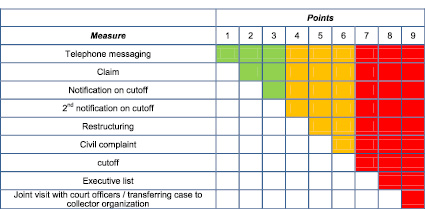

4. Depending on type of debtor and his grade, measure of collecting debt is defined (fig. 2).

5. Analysis of the selection of billing system is carried out via additional toolkit for MS Excel “Inventor” – a set of utilities (macros and functions), aimed to carry out ABC-analysis that complements and widens abilities of standard Excel.

Ranging debtors according to total sum of debit liabilities:

Fig. 1. Matrix of managing debit liability according to ABC-analysis

Fig. 2. Measures of collecting debit liabilities

– Group A – 80 % of debt, 14 thousand customers (26 % of total amount) and total debt sum of 86 million rubles;

– Group B – 15 % of debt, 20 thousand customers or 37 % of total amount and total debt sum of 16 million rubles;

– Group C – 5 % of debt, 20 customers or 37 % of total amount and total debt sum of 6 million rubles.

6. Evaluating efficiency of measures [3], aimed to manage debit liabilities, was suggested to carry out via method of EMV (Expected Monetary Value), that compares the following indexes:

– volume of debt within a group of debtors, weighed according to probability of its collection depending on level of measure, defined for a certain debtor.

– volume of costs, weighed according to probability of losses due to insufficient payment for a debt.

7. Results of approbating toolkit of managing debit liabilities have been evaluated according to EMV method.

For collection plan of this selection during the studied period of 30 % (traditional methods of collecting debts) actual (re-engineering of business-process) collection of debit liabilities equaled 58 %. The share of costs, aimed to collect debts equaled 3, % of this volume that is significantly lower than existing tariffs for services of collector organizations.

Possible practical implementation of the results:

1. Developing methodical toolkit of managing debit liabilities of population to a point of transferring it to resource-supplying companies.

2. Developing a module of automatic work place “Management of debit liabilities of population” for the existing billing systems.

Thus, re-engineering business-process of managing debit liabilities of population allows us to achieve optimization of costs for resources, aimed to collect debts. Increase in probability of collecting a debt and, therefore, amount of the collected debts, will have a positive impact upon decrease in cash gaps, decrease in costs of paying percent for using borrowed funds.

Results of the initial approbation show us significant economic effects during the early periods of introducing the toolkit that allows us to state economical suitability of carrying out re-engineering of this business-process.