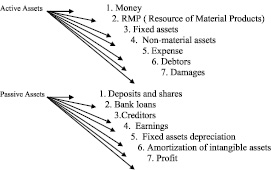

In the transition to market conditions as well as all other entrepreneurs of Atyrau accounting was not easy. To open them different professional courses, conducted trainings, etc. Entrepreneurs for accounting had almost memorize the chart of accounts in accordance with IFRS (International Finance Reporting Standard), which consists of more than 200 types of accounts and their four-digit codes. For intensive development of accounting beginners and existing entrepreneurs, we offer the use of «5SIS» which involves the use of 41 basic accounts. Any entrepreneur, well spend system «5SIS» easily be able to properly maintain accounting records and eventually make its own balance. The system «5SIS» figures are 7 and 41, not only for better memorization, but also because the numbers in the Kazakh people are the most sacred signs. So we know that the accounts are divided into active and passive. To find out which accounts are active, and which accounts passive divide all the assets of the enterprise in two ways: on the composition and placement of sources and their education, and every kind of divide into 7 groups.

Further, these two «sevens», that is active and passive assets are coded in accordance with IFRS and eventually get easy working chart of accounts, which includes 41 score, 17 of which are active and 24 passive.

Easy working chart of accounts

|

Active accounts |

Passive accounts |

|

1. Money – 1010, 1030, 1040 |

Deposits and shares – 5030 |

|

2. RMP – 1310, 1320, 1330 |

Bank loans – 3010, 4010 |

|

3. Fixed asset – 2410 |

3. Creditors: A) Taxes – 3110, 3120, 3130, 3140, 3150, 3160, 3170, 3180, 3190 B) Salary – 3350, 3210, 3220, 3397 B) Distributors – 3310 D) Rent – 3360 |

|

4. Intangible assets – 2730 |

4. Income – 6010, 6210, 6280 |

|

5. Fixed assets depreciation – 7010, 7110, 7210, 7410, 7470 |

5. Depreciation – 2420 |

|

6. Debtors – 1210, 1250, 1420 |

6. Amortization intangible assets – 2740 |

|

7. Losses – 5610 |

7. Profit – 5610 |

Now, form a countable formula.

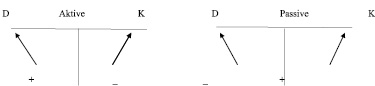

Fig. 1. The Counting Formula

The essence of this counting formula as follows: if the account is active, any increase in it (+) is debited and decrease (–) is credited. If the score is passive, then any increase in it (+) is credited and decrease (–) debited. Let us remember that between accounts under IFRS there is a close relationship, which is called the correspondence accounts. And this relationship or correspondence accounts reflected as a financial transaction.

Now, consider each step system «5SIS» individually on the following example business operation.

1. Received in cash from the founders deposits amounting to one million (1 000 000) tenge.

I step. Carefully read the business transaction (in this example, capitalized cash to the cashier).

II step. Determine the parties involved in this operation. Usually one side gives and the other receives (in our example, the first – party deposits and shares, and the other side – the ticket office).

III step. The present step consists of three stages. Here we define the three elements of the parties involved:

A) Codes (account number).

B) «+» and «–».

C) A and P (active or passive).

Then we obtain (see Fig. 2):

A) According to an exemplary chart of accounts places a four-digit codes of these parties (in our example, deposits and units – account 5030, cash – 1010).

B) «+» and «–» here we determine the increase or decrease of the parties (in this case, next to the code 5030 put a «+» sign, that is the amount of deposits increases, and next to the code 1010 also put a «+», that is Box Office is also increased. Signs «+» and «–» depends on the contents of business operations. may be «+» and «+»«–» and «–», «+»and «–», «–» and «+».

C) Characteristic refine these accounts (in our example, the account 5030 «Deposits and shares» – passive, and the bill in 1010 «Cash on hand» – active. We use the working chart of accounts in accordance with IFRS (Table). That is Account 1010 top notes letter A (active), and 5030 due to the letter P (passive).

IV step. To do this, we look at the final scheme III step (Fig. 2) and the counting formula (Fig. 1). And we conclude that the 1010 account is debited and credited to account 5030.

V Step. Prepare a draft of the expected accounting entry. According to the rules first written DR, and then CR and recorded programming. V Step ends with the accounting entry, the result is:

DR CR Total

1010 5030 1000000

Fig. 2. In the third step

We believe that this system can be successfully mastered by individual entrepreneurs who do not have special economic and accounting education.

Nowadays, every entrepreneur your accounting and tax accounting is an automated form of «1C» or «IP Accounting», he can choose himself – whether to keep records in electronic form or on paper. Mandatory requirements for individual entrepreneurs about bookkeeping is in electronic form no. In particular, especially accounting for individual entrepreneurs operating under the simplified system, painted in the order of the Minister of Finance of the Republic of Kazakhstan dated June 21, 2007 № 218 «On approval of the National Financial Reporting Standard number 1 (NFRS 1)».

Also on the System «5SIS» we offer two options for document management for individual entrepreneurs.

According to a first embodiment of individual entrepreneurs offer the following document, which consists of 10 units (1 book and 9 statements):

1) The book of income for SP

2) Registers (9 kinds of statements) accounting (the list specified in the standard):

● B-1 statement for accounting of funds.

● Statement B-2 on inventory.

● Statement B-5 accounting settlements with buyers and customers.

● Statement B-6 accounting of payments to suppliers.

● B-7 statement on accounting wages.

● In the statement of 9 – accounting of biological assets.

● In the statement of 10 accounting movement of fixed assets and intangible assets.

● Statement Q-11 on accounting for depreciation of fixed assets and intangible assets.

● A summary statement of B-13.

In the second embodiment, individual entrepreneurs who work on generally established regime, should enjoy a full accounting.

For these entrepreneurs system «5SIS» we offer the following document, which consists of five groups:

1. Source documents.

2. Journal of operations.

3. Cash – negotiable statement.

4. Balance sheet (1, 2, 3, 4 form with an explanatory note).

5. Tax returns.

Note that the use of Atyrau entrepreneurs doсumentation the second embodiment for the last 10 years, gives excellent results.

Thus, the development of small and medium-sized businesses have always been a priority in Kazakhstan. And now the Government of the country developed regulations or legislation for the grant and protection of common interests and the interests of each of a small and medium-sized businesses, providing the most favorable conditions for business development.

But often, the entrepreneur is difficult to find information on their own, and even more difficult to understand it. Changing legislation, the terms of trade, the rates of duties and taxes, increased requirements for compliance with labor and environmental protection, etc.

We hope that the use of this system «5SIS» will help many entrepreneurs.

The work was submitted to International Scientific Conference «Development of scientific potential of higher education», UAE (Dubai), March, 4–11, 2014, came to the editorial office оn 07.02.2014.